Accounting Software and FranScape

How to use FranScape alongside bookkeeping and accounting software.

FranScape has a number of options of simplifying record keeping for customers. The best option to you depends on how your business is structured. You are strongly advised to seek the advice of an Accountant before proceeding.

Principle

FranScape is not an accounting system and you should operate a specialist accounts package. Please ask you accountant for information on the right options for you.

Part of FranScape's features is a full and detailed record of every customer's interaction with your business. This includes sales, credits and what amounts are paid by a variety of methods.

Financial accounts are prepared in one of two ways

- Cash accounting

- Accruals

Depending on which basis you use will determine the options you have for extracting data to input into your accounting package.

Amounts received in to your bank are after Transaction Fees. You will need your FranScape invoice to reconcile these. These are emailed to you, if you require a copy please contact Support.

Cash Accounting

This is the most common way Franchisees account for their sales when using FranScape.

FranScape keeps full customer financial records but does not keep accounting records. To ensure the correct cash accounting records reach your accounting package you have following broad options:

- Connect you Bank Account(s) to your accounting platform marking income as Sales as appropriate.

- Export transactions from FranScape using the Payments and Refunds Report and import via CSV.

As FranScape makes payments in Weekly batches in arrears, there is likely to be a difference between what is received in to your bank in a given month and what is declared through FranScape.

To reconcile this difference you will need to know about amount is "In Transit", in other words, money that is on its way to your bank.

To do this go to 'Company Information' and select Stripe Dashboard to see the full records of Payouts to your bank.

Accruals

If you are using the Accruals basis for accounting, options 1 will not be appropriate.

You can still use Option 2 and export transactions for any given date range via CSV into your accounting package using the steps above

Please be aware this will give you line by line transactions per customers whereas your bank may receive income from Stripe in batches.

To Export transactions in FranScape:

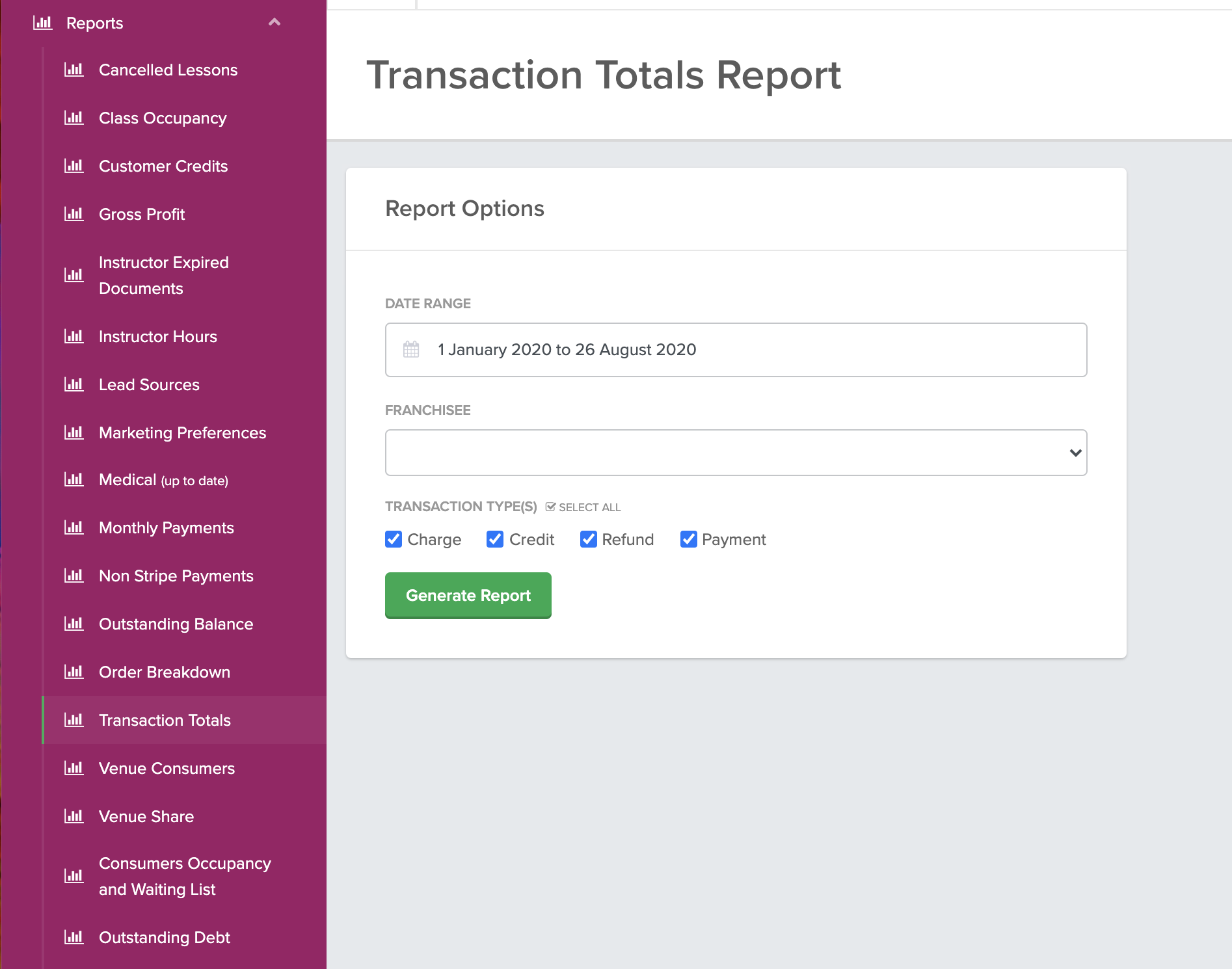

- Click on 'Reports' on the left hand pane

- Select 'Transactions Totals'

- Choose the Date Range your require i.e. 1st January 2020 to 31st January 2020 - the system will recall all data held

- Choose the correct Franchisee

- There are 4 transaction types to report on, you can report all 4 at once:

- Charge - when a customer has been charged for a service (i.e. invoiced - regardless of if they have paid)

- Credit - a list of credit applied by customer

- Refund - a list of refunds made by customer

- Payment - a list of payments made, monies received regardless of method, by customer - for a break down of non Stripe payments please chose the Non Stripe Payments report

- There is an export button to CSV at the bottom of the page once the report has been run - this file can then be uploaded into any major accounting page.